After the company’s first full year of profitability, is the stock a buy?

Martin Eberhard and Marc Tarpenning established Tesla Motors in July 2003. Nikola Tesla, an inventor, and electrical engineer is honored in the corporate name. With a $6.5 million investment in February 2004, Elon Musk rose to the position of the company’s largest shareholder. He assumed the position of CEO in 2008. The Model 3 is the plug-in electric vehicle with the highest global sales volume, and in June 2021, it became the very first electric vehicle to sell one million units worldwide. Tesla sold 936,222 vehicles globally in 2021, a growth of 87% over the previous year. As of August 2022, the company has sold a total of 3 million vehicles. Tesla became the sixth corporation in American history to have a market valuation of $1 trillion when it did so in October 2021.

The Tesla Stock price prediction for the years 2022,2025, 2030 will be covered in this article.

Tesla share price history

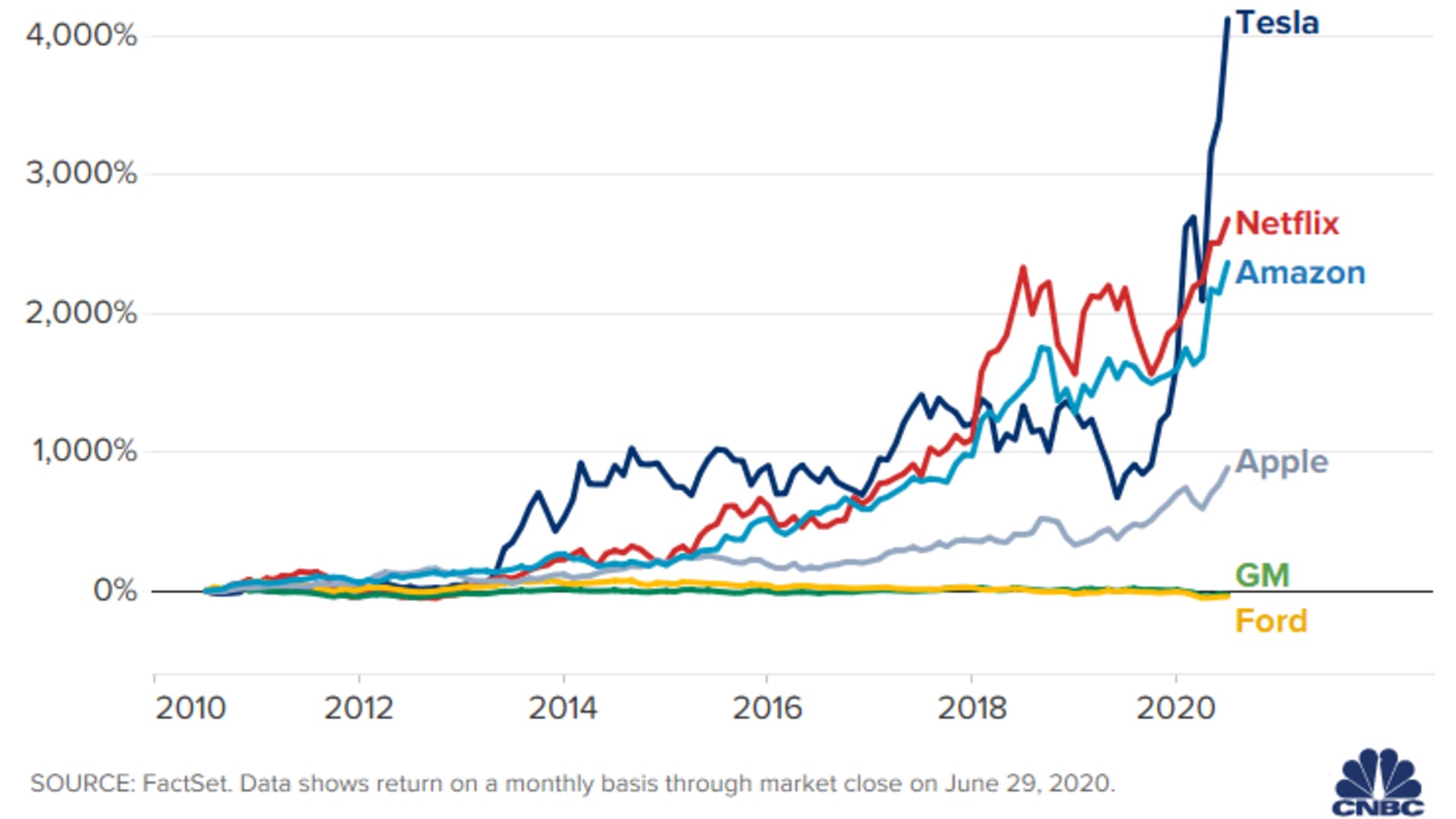

Tesla launched its initial public offering in 2010. When it went public, the Tesla stock price was trading at a split-adjusted rate of $5. Since then, the TSLA stock has jumped by more than 28,000%, making it one of the best performers in the market.

While the long-term performance of the TSLA share has been good, the journey to the top has not been smooth. As shown below, the stock declined by 38% within a few months in 2015. Similarly, it then dropped by 56% within a few months in 2019. At the time, Elon Musk even warned that he had funds secure to take the company public.

Is Tesla a good investment?

While Tesla is an overvalued stock, there are reasons to believe it is a good investment. First, the company has a good market share in the fast-growing electric vehicle (EV) industry. While more companies are entering the scene, Tesla has maintained its market share. The chart below shows the Tesla market share in EVs.

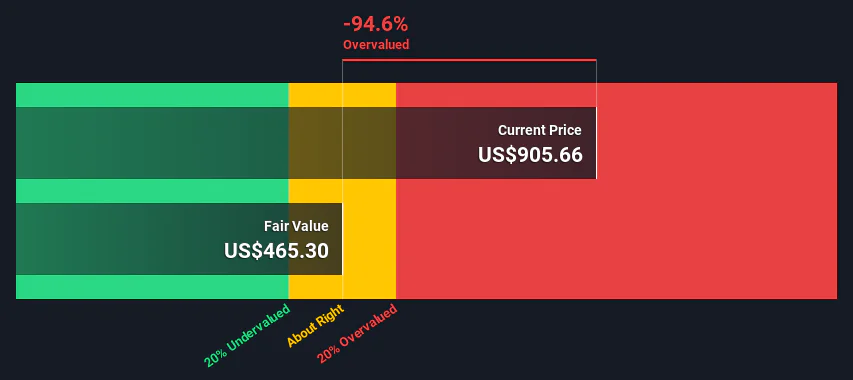

Is Tesla overvalued?

Most analysts believe that Tesla is an overvalued company. However, most of them justify this valuation because of its market share, revenue and unit growth, and upcoming projects like semi and cybertruck. A DCF valuation on Tesla shows that the stock is highly overvalued. It has a fair valuation of $465 per share, significantly below its current level.

Meanwhile, analysts’ average estimate of the Tesla stock price target is $934. Those who have a bullish rating are from Credit Suisse, Canaccord Genuity, and Oppenheimer. On the other hand, some of the analysts short the stock are from Barclays, JP Morgan, and Citigroup.

Tesla stock price forecast 2022

The year 2022 seems to be the exact fortune bliss for TSLA stock owners. The highest price up to which the stocks can reach is estimated to be around $379.75, while the lowest is predicted as $331.50. But no one needs to worry much because if the market remains stable and the prices do not go high or low, the average that this stock will be balanced is at $355.00. Tesla, as we all know, will never disappoint or become a reason for loss for its shareholders.

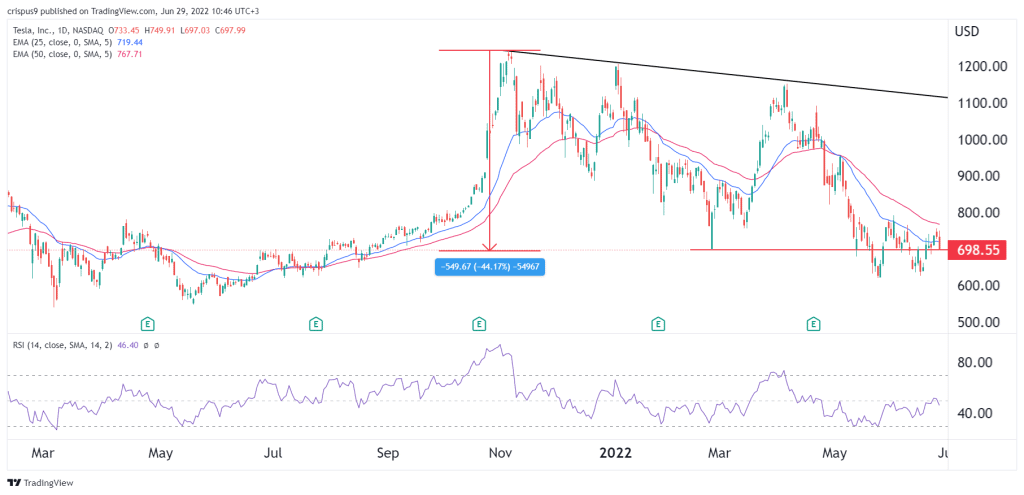

Tesla share price analysis

The section above was our previous Tesla share price prediction. As you can see below, this outlook was accurate as the stock is still on a path to $563. The TSLA share price remains below the 25-day and 50-day moving averages and it has formed a triple top pattern. Therefore, the overall outlook of the stock is bearish, with the next target being at $500.

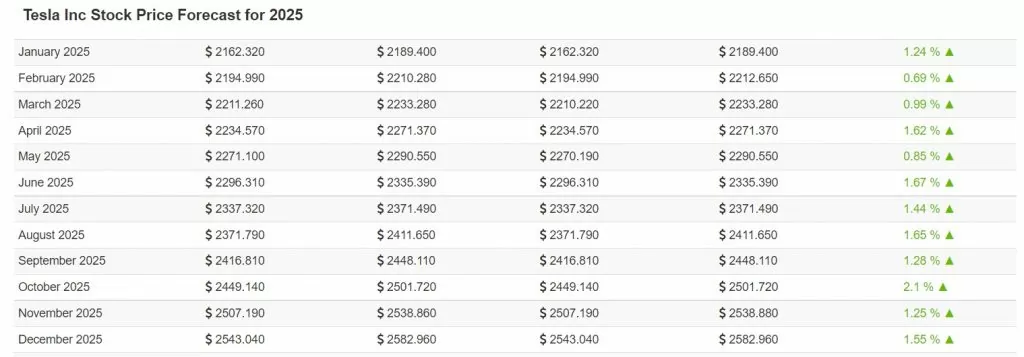

Tesla stock price prediction 2025

I expect that TSLA shares will be significantly higher than where they are today by 2025 and 2030. At the time, the company will be highly profitable as the world moves to electric cars. As shown below, analysts at Wallet Investor expect that the stock will be trading at above $2,500 in 2025.

Tesla stock forecast 2030

Tesla is among the most innovative corporations in the world, so we predict sustained success for the company. Furthermore, by 2030, we anticipate a significant increase in the share price. According to analysts, Tesla will hit $3,000 in 2030.During the first half of the year the value of Tesla stock will rise to $3,000

Tesla biggest shareholders

Top 10 Owners of Tesla Inc

| Stockholder | Stake | Shares owned | Total value ($) | Shares bought / sold | Total change |

|---|---|---|---|---|---|

| The Vanguard Group, Inc. | 6.20% | 194,251,740 | 51,525,274,035 | +8,916,054 | +4.81% |

| BlackRock Fund Advisors | 3.40% | 106,406,025 | 28,224,198,131 | -731,040 | -0.68% |

| SSgA Funds Management, Inc. | 3.04% | 95,363,172 | 25,295,081,373 | -1,921,149 | -1.97% |

| Capital Research & Management Co…. | 2.89% | 90,506,664 | 24,006,892,626 | -18,395,970 | -16.89% |

| Natixis Investment Managers Inter… | 1.46% | 45,844,881 | 12,160,354,685 | +44,338,443 | +2,943.26% |

| Geode Capital Management LLC | 1.41% | 44,250,381 | 11,737,413,560 | +1,237,278 | +2.88% |

| T. Rowe Price Associates, Inc. (I… | 1.36% | 42,699,258 | 11,325,978,185 | +3,953,061 | +10.20% |

| Fidelity Management & Research Co… | 0.97% | 30,301,713 | 8,037,529,373 | +669,351 | +2.26% |

| Jennison Associates LLC | 0.94% | 29,537,760 | 7,834,890,840 | -1,000,557 | -3.28% |

| Baillie Gifford & Co. | 0.90% | 28,212,912 | 7,483,474,908 | -1,223,847 | -4.16% |

Should You Buy Tesla Stock?

The ride for shareholders seems to be smoothing out as the company meets quarter after quarter of profitability. That said, investors can’t ignore Tesla’s off-the-charts valuation multiples. And though the company reported $31.5 billion in total revenue for 2020, its current market cap is nearly $800 billion.

Tesla has grown into the largest car company in the world and now sits comfortably atop the industry. If things continue to go Tesla’s way that’s not likely to change anytime soon, and if history is any guide, betting against Musk tends to be a bad call.

That said, the risks remain – Tesla is no longer the only EV company worth watching, and investors need to be prepared for the idea that its better-established rivals may supplant Tesla’s position. In short, investors with interest in buying TSLA shares should add them to a well diversified portfolio safe advice for whatever stock you’re considering.

Conclusion

Tesla is a reputable firm and is not going to face any serious issues anytime soon. The corporation has established itself as being among the most reliable companies in renewable and sustainable energy and space missions through Elon Musk-owned SpaceX Organization. From the section above, you can see how Tesla’s stock value has increased over time. You can observe that the stock’s price varies from time to time. Additionally, you can see that the commodity’s value has increased considerably over time. We’ll now examine the stock’s prospective price. We must examine price forecasts from reliable sources that make use of the most advanced algorithms and analytical techniques. However, investing in and holding TSLA stocks is always a wise choice.